-

Publish Your Research/Review Articles in our High Quality Journal for just USD $99*+Taxes( *T&C Apply)

Offer Ends On

Anders Kjellman*, Thomas Finne, Taisto Kangas and Risto Tainio

Corresponding Author: Anders Kjellman, AKC and Novia University of Applied Sciences, Finland.

Received: November 15, 2022 ; Revised: December 05, 2022 ; Accepted: December 08, 2022 ; Available Online: December 22, 2022

Citation:

Copyrights:

Views & Citations

Likes & Shares

Resilience in banking is about the ability to anticipate, prepare for, respond to, and adapt to change, to survive and to prosper. It reaches beyond risk management towards a more holistic view of bank survival. This study explores the key factors that build bank survival and resilience. We apply a mainly qualitative research approach with an adaptive research design, i.e. we ask bankers and analyze our own and others banking experience. In order to find a usable model for bankers we develop a Six-M model behind resilient banking: 1) Money, 2) Markets, 3) Management, 4) Me = We, 5) Meaning, and 6) Moderate technology response. One crucial lesson to be learned by bankers is that ESG, value management and meaning are important factors behind resilience.

Keywords: Bank resilience, ESG, Strategy, Six-M model

The hard part is to figure out what works well today and far beyond tomorrow?

The Nobel committee (2022) and Sveriges Riksbank awarded the Nobel prize in Economics to Ben S. Bernanke, Douglas W. Diamond, Philip H. Dybvig “for research on banks and financial crises”. An important finding in their research is why it is vital to avoid bank collapses [1]. However, vital parts in bank research are still unsolved. One crucial issue in how to create resilient banks and banking systems in a volatile world. The purpose with our research is to shed some light on what resilient banks are good at. Thereby this article contributes to enhancing the knowledge on resilient bank management.

We see resilient banking as a process of trust and the art of maintaining long-term bank survival, while getting good things done for the society through and with co-workers and other stakeholders. Thus, we see profitability as one of the main keys behind successful, resilient banking. By shown profitability and support for Environmental, Social and Governance (ESG) factors, the crucial issue of trust in banking can be maintained and reinforced.

Resilience in banking is a broad and complex concept [2-5]. Leo [2] notes that resilience is broadly defined by many as the capacity of a system to avoid disturbance and reorganize while undergoing change so as to still retain essentially the same function, structure, identity, and feedbacks. We saw a small research gap due to a focus on reacting, avoiding or reorganizing and not anticipating or creating change in the financial sector. Thereby we opted to base on previous definitions and discussions [2-5] define resilience in banking as the ability to anticipate, prepare for, respond to, and adapt to incremental change and disruptions, to survive and to prosper. It reaches beyond risk management towards a more holistic view of long-term bank survival.

In a digitalized and finance-driven world, we assumed that the role of technological knowhow and fintech capabilities would be among the key factors behind successful banking [4-9]. However, one of the greatest surprises that we encountered during the quest for knowledge on resilient bank management was that technology level was not found to be crucial for long-term success. Fintech capabilities and a solid bank platform are, of course, a must in the 2020’s when it comes to banking. However, we looked at, worked with and tested different markets and sectors of banking and still could not find evidence that bank platform quality, nor size would be a key factor behind resilient banking. In the Nordic countries, one can note that the biggest spenders in bank technology are not the best value creating, nor the most liked banks. One example of this is the largest bank in Northern Europe, Nordea that has invested heavily in its bank platform development, while seeing its market value and customer base reduced during the last decade.

If technology is not the key gamechanger, then what is behind the results of the resilient banks? Banks that can transform, in accordance with the demands of a finance and technology-driven world?

MATERIAL AND METHODS

The data has been collected since 2011 when a group of researchers, bankers and authorities in Finland formed a consortium. Over the years the seminars and research questions and methods have differed. However, the result of this study has mainly emerged though a qualitative research approach with an adaptive research design or to put it more understandable through discussions and interviews with bankers and researchers. Furthermore, some of the writers have worked in global banking for several decades and through different financial crises. The bulk of the interviews, discussions and observations have been conducted in the Nordic countries in Europe.

The unstructured research design has limitations; however the complexity of resilience and good banking pushed us into an abductive approach in order to obtain useful results for the banking industry. We have during the process noticed that bankers’ perceptions and experiences of reality are based on subjective views that may change over time and in a different context. The base for our study relies on surveys (more than 400 bank managers), observations as bank managers over several decades, and interviews with bank managers. Still, we were facing severe epistemological and ontological challenges. What are we observing and what kind of knowledge base are we applying? To start with, what is actually good bank management?

We decided to define “good resilient bank management as long-term, constant value creating banking activity that maintains profitability both during good and bad times, while maintaining loyal customers, loyal employees and loyal owners”. Thereby, our definition of good bank management supports the issue of long-term survival as well as the loyalty effect suggested by Reichheld [10].

We started our research process by discussing with - other - bank managers concerning what is typical behind bad and good banking? The road towards banking that led towards failure crystallized fairly fast and we could identify typical decline stages of banking already in 2014 based on 309 bank mergers and previous research. The typical decline started with a growth phase, which blurred the foresight of bank managers [7]. However, also the successful banks grew! So a far harder part was to identify typical patterns behind great banks and bankers. After several additional years of research, we managed to identify a potential map towards resilient bank management that may lead towards good bank management. This map consisted of 6 checkpoints that was tested and found reliable.

We have seen a few bank managers succeed and many more bank mangers fail in their strive to succeed and survive in the highly complex world of finance. In our efforts to simplify what resilient bank management is about, we ended up with 6 main checkpoints. These emerging six factors seem to be common for the banks that have excelled over time and are likely to improve resilience also in the future [6,7].

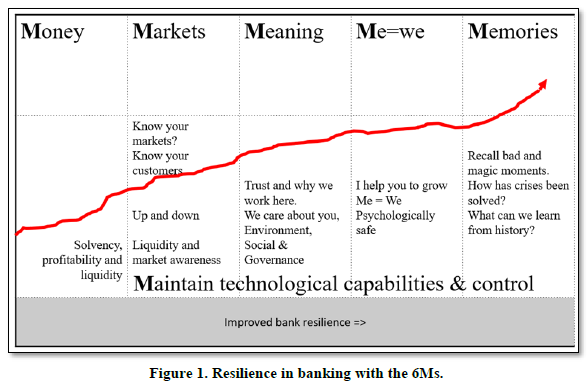

We will begin by mentioning the 6Ms of resilience in banking. Good bank management concerns the banking elements: 1) Money, 2) Markets, 3) Meaning, 4) Me = we, 5) Memories and 6) Maintaining and controlling technical capabilities. Some of these M’s have previously been used to explain modern management (Figure 1); however a combination of market understanding, organizational performance and individual behavior is rare in banking literature. To understand the market and the generative complexity of money, creation and supply have been used to explain what bank management is all about. However, fairly, few have stressed the role of the bank managers’ perceptions of their role in combination with other complex factors [6,9,11,12].

In our efforts to simplify what resilient bank management is about; six main issues or checkpoints have emerged both at a bank and a personal level. The first three of the Ms have been used to explain what bank management is about, and the last two of the Ms we will use to explain the cultural and psychological capital in management. Some of the 6Ms partly relates to Daniel Goleman’s Emotional intelligence (EI) and refers to our ability to recognize and manage our feelings, to empathize, and to interact skilfully. The banking business is uncertain, comprehensive and complex. A good bank manager can try to prevent crisis and bad banking through a highly trained, educated and motivated workforce. Through the 6 Ms, we will demonstrate what good management and performance in banking are built from.

Why would anybody give you their money? Well, they trust your decision making capability and your institution! Banking concerns trust, which is a complex and divergent phenomenon. Banking relates to trust creation which boosts deposits and risk capital, i.e. a willingness to either lend the bank money or invest in the bank’s services. “It takes money to make money”, is an old saying in many cultures. If you have money you can start to invest money in the bank’s lending portfolio and other provided financial services. Thereby the banks start to earn money from interest rate differentials, fees, services, etc. Have you ever thought about why the most profitable firms borrow the least? Many firms today as well as in the past do not borrow money at all! These firms are often also the most profitable and successful firms!

If you can generate a cash flow that covers your future investment and all other expenditures, then you are in a great position. The own capital rate to total assets for a successful and profitable firm is in general above 60%. Often, it really does take money to make money [6]!

Money is the key product and service of any Financial Institution and it is of vital importance to develop, sell and sustain this key product and service mix of money What is it that the customers want and how do we not only get the money back, and an adequate ROI, but also maintain happy customers as well as bank owners?

The basic question concerns how we make money in banking. Every year before, during and after the Depression of the 1990’s in Finland, one local bank managed to show better and better results. For over 4 decades the bank, Kvevlax Savings Bank was run by the legendary banker Sven-Erik Kjellman and it was the most profitable (%) of the banks in Finland during and after the years of the 1990’s depression, as well as one of the most liked banks by the customers. The former CEO of Kvevlax Savings bank Sven-Erik Kjellman noted “that you need to know your customers, lend to people you trust and charge a slightly higher price than your own cost of capital, and get the bank’s money back. It is not harder than that” [6].

You need to earn money in the long term, not lose money. Regardless of how you make money, make sure that you know how you do that and who your customers are. Among other important factors mentioned by Kjellman is the good advice that you should constantly keep the board of the bank informed about what is happening concerning money, both inside as well as outside the bank, and that a bank should have good solvency and liquidity.

As noticed by Kangas [11] the nature of a bank loan is not a sales process; it is much more. It is also a juridical process of getting the money back - with a profit - and even in some cases helping the customers to pay backs the loans that you have granted. It is good to remember that excessive borrowing dilutes a bank manager’s space of movement more than excessive lending, since in the former, a bank is more dependent on the bank’s borrowers. A banker should therefore always keep an eye on how the bank is getting money. If you rely too much on short-term money market assets, you will have to look into your liquidity risk. It can be hard to obtain money from money markets when things are going badly for your bank or the general economy. Furthermore, many banks have failed due to liquidity problems, nobody deals with you in the short-term money markets, and depositors are starting to withdraw their deposits, which may lead towards a liquidity problem or, even worse, a bank run.

The key issue relates to how much own money your bank has and what is the quality of the own funds. If you borrow too much your ability to absorb shocks will be hampered. Many banks are stretching their balance sheets, showing only about 1% to 5% of real own capital to Total Assets. This is not a good long-term strategy, because when markets enter into a recession, then the risk for credit losses and bad loans increases When we looked at banks and countries that had done well during depressions, we found that they had a real own capital level of about 10% to Total Assets. This may sound like a lot to most bankers! However, during hard times, if you have money it is easier to make more money, as banker Sven-Erik Kjellman noted when the resilient Finnish savings banks in 1995 saved Aktia Bank through a capital injection. The aim was to get a yearly 10% return on investment, and that they did. You can buy at a lower price during a recession compared to boom times.

When we started to look deeper into the issue of how much own money should a bank have, we were just struck by the fact that we had the answer right in front of us for a long time. Already, with data from the 1980’s, you could find that the stable banks had a solvency ratio (= own capital to total assets) of above 10% and that the troubled banks that were to end up in the history books had a solvency ratio far below 10% as also noticed by Kangas [11], Kjellman, Kjellman [6]. Our analyses of the data based on EU banks just confirmed the fact that the stable, resilient banks have a solvency ratio of at least 10% own capital to total assets. “It is easier to make money if you have money” [6-9]!

Halton and many of our friends in Central Banks also reminded us about the fact that Canada had virtually no bank failures in over 180 years, and one explanation for this was that they had to historically survive on their own, without central bank interference. Thus, a solid solvency level (often over 10%) was built-up over time in the Canadian banking system. However, we note that as ‘always’ reality is a little bit more complex than one single factor [6,12].

The lesson concerning money is that you have to have enough own money, i.e. own capital in relation to your on and off-balance sheet exposures. A basic rule of thumb for a prudent and resilient bank is that you should have at least 10% equity to total assets (including off-balance sheet exposures).

Markets go up and down. Kjellman [6] argues that we live in a world of nuclear finance in which the market can move fast and unexpected. Yes, you read right, unexpected! ‘Nobody’ warned about a potential Global Financial Crisis before it was a fact in 2008, with the fall of Lehman Brothers. Virtually, nobody grasped the potential disaster. That is a lesson to be noted. In the ‘Age of Nuclear Finance’ (a concept coined by Kjellman [6]) things may change fast and unexpectedly blow-up in your face. “Nobody” warned about the corona pandemic 2020 nor the Russian attack on Ukraine 2022! The COVID-19 crisis just hit all parts of the global markets in the spring of 2020, and nobody could escape the virus [6]!

In traditional retail banking, a good starting point is to look forwards and backwards and ‘estimate’ in which ways the markets (demand, supply and expectations) are most likely going. You need to know your customers i.e. your market. And how to serve the customers so that the customers and the community will prosper. There is something in the old saying: if the bank manager can see all their customers from the church tower, then, the bank is doing well. This strategy is applied in Handelsbanken as well as in many local banks, which seem to assure a good future for these banks. The opposite, we have seen a lot of times in big banks; an arrogant and omnipotent management, focusing on profit, power, growth and not customers.

The rise of the shadow banking market and repackaging of “housing” loans from 2000-2007 in the US is a great example of how banks all over the world lost tracks of their customers and lost their senses of market risk. Amadeo [13] notes that since the US banks repackage and sold your mortgage, it can make new loans with the money it received. This was a game changer disruption of the US financial system, which the Fed had allowed and some even accuse the Fed for contributing to the crisis creation. The disrupted innovation of the shadow banking industry was creating ‘new money’ and led to an on-lending industry that started to get out of control. In 2008 Lehman brothers failed and the world was thrown into a global financial crisis. This “new money” phenomenon is something that has happened throughout history, and will happen again, with so-called ‘new’, ‘should be safe’ products like cryptocurrencies [6,13].

A good banker is expected to see upcoming and potential trends and be able to react in accordance. This might be a potential change of interest rate levels, the legal environment or economic policy.

Stop trying to make sense of the stock, derivative or crypto currency markets. They are just volatile and full of emotions and even fraud. Thus they can quickly change in any way and direction.

However, when you look at historic data you will find some clues. Yes, markets go up and down. And investors will from time to time be either extraordinarily optimistic or pessimistic. Robot trading, war, diseases and AI is not going to make that situation change.

The lessons concerning markets are that they go up and then you need to be cautious. Look ahead and ask yourself if we should be in this market. Furthermore, notice that the big lesson to learn from the banking history is that you need to have sufficient funds of your own. Because in that way, you are prepared and can also take advantage of opportunities during bad times.

What is meaning in banking activity? Why do I work here? To become rich? To create added value for customers and owners and thereby indirectly for society? What is meaningful magic in banking that will motivate the employees, customers and owners? A simple answer is that we, the bank, help you and the society! We help the local community to grow in a sustainable ESG way! We are socially responsible while creating shareholder value. That is one of cornerstones of resilient banking.

‘Built on value’ is what the most resilient banks and firms are built on. Helping others to prosper is one of the key factors behind survival in banking! You do not deal with criminals; instead you deal with the ‘good guys’ who make the world a better place. The Bank of America has been the world’s largest bank, and they were good at creating meaning in the sense that they helped the surrounding community, e.g. by financing the building of the Golden Gate Bridge, and Walt Disney in the 1930’s, or being the first bank to open after the 1906 earthquake in San Francisco.

Meaning in banking can be different things for different actors. However, we see long-term profitability as one of the key magic creators in banking, and bank employees that know that they are good and have a ‘secure’ workplace. The employees can feel a meaning and magic in both their own work as well as their contributions to the surrounding community. A supportive, enabling and positive atmosphere can be found in the best performing banks. We find a proudness and meaningfulness that sparks and maintains a tradition of meaning (and magic) in the best preforming banks.

Profitability is not the meaning of a bank, it is a must! You simply must be profitable in order to be able to meaningfully run a bank. If you are not making money, you are not going to be able to provide safe surroundings for your co-workers provide a return for the owner or be an appealing place for customers. So, you simply have to be profitable every year, no matter what the markets throw at you.

In capital and assets-based banking, as well as in the shadow banking system, trust creation is as crucial as in retail banking. A good story about long-term relations, and trust creation for the good of both the customer and your financial institution is a good starting point.

Meaning in banking is caring for your bank, your co-workers, customers and owners. It is also about caring for the environment, society and governance issues (ESG). In practice, meaning often means motivating your co-workers, thereby creating a safe and sound work atmosphere. This is one of the often forgotten keys to good management and resilient banking. Are you able to grow the confidence and skills of your employees; and your customers? The question; ‘why do I work here?’ needs to be addressed often. And it is a question that is frequently forgotten in the hectic life of a banker in the age of nuclear finance. You may start by asking yourself: ‘how can I help my boss?’ The answer to this question is a great starting point in any sort of leadership.

One lesson to be learnt concerning the meaning of bank activity is value management. ESG is part of the answer to the question on why the bank is selling services, and how the bank can help the customer and the surrounding community to grow.

As a bank manager, one of your largest challenges is to ‘motivate and grow’ the team members of your bank. It is all about teamwork, and then your greatest skill is empathy!

We live in a self-centered world of greedy individuals. Do you have the moral and ethical standards that are required for suppressing monetary greed and short-terminism? Do you allow and help others to grow and give credit to them, for things that they have done well? Do you have the skills to motivate, learn and teach others to grow? Are you an honest actor, modest and truthful to yourself? If your answer to all these questions is yes, then you have what it takes to become a good banker. The bank has a strategy, which you need to know; however, you should start with your own personality and actions. To be happy and supportive is much easier said than done. However, remember that other people have entrusted you with their money, their savings and, in a way, their wellbeing. That should make you feel happy!

An interesting aspect of ‘Me = We’ relates to the customers of the bank! Should you associate with the customers? The answer to this question is tricky! In principle, you go hand in hand with the customers in both good and bad times. Yes, to a certain degree you should be friends with the customers and help them grow. However, there is also a point when you cannot be too friendly with a borrower. Yes, when things go well it is easy to be friends, however when things turn bad you are in a tricky situation.

We note that we live in an egocentric world of me, me and other ‘Me’s’, and lots of mess. The crucial issue as a good bank manager is to create meaning and belonging among co-workers, customers and owners. Me actually equals we in banking.

Emotional Intelligence is a concept ‘created’ by Goleman [14], and today it is a standard theory in leadership books. Self-awareness, emotional self-control and empathy are vital in our ability to forge meaningful relationships and understand a part of complex human nature. Empathy enables us to listen and understand the diversity of perspectives among customers. Empathy enables us to be more tolerant and have more harmonious interactions with our co-workers as well as customers. That being said, you, as a banker, will still have to say no to deals that are not right. Do not give loans to people that you do not trust [6,14].

Managers learn from experience, reading and imitation. Rareness of events like Mergers & Acquisitions (M&A) make it harder to learn. So, do not expect that you will be able to master all elements of a due diligence process following an acquisition. Do ask for help and advice from more experienced co-workers or other experts. It is good to learn from your own mistakes; however, it is even better to learn from others’ mistakes. So, one of the lessons to be learnt is to have somebody to discuss the problems with.

Recall psychological safety which helps your co-workers and bank to grow; be modest; take care of you, and have a life outside the bank. In banking, I actually equal us. Maintain a solid moral and ethical compass.

It sometimes appears that bankers are not that interested in the past activities of the bank. Young bankers do not seem to recall the past mistakes of the banks nor know how the banks survived hard times like the Global Financial Crisis of 2008 or the 1930’s Depression?

In retail banking, it is a must to know your history of the bank, customers and the economic development. Most of the time you will be successful; however, bad periods usually follow periods of growth. It is good to recall the debt-deflation theory of great depressions. In 1933, Irving Fisher published his study of great depressions and found that they all seem to follow a clear pattern of initial debt expansion, followed by a situation where asset value is falling, people become unemployed, causing defaults of loans, thus causing prices to fall further and we have deflation. The Great Depression of the 1930’s led to a fall of the US housing market (50% to 60%), causing a decade of low housing prices that ‘depleted’ people of their buying power [6].

Capital-based banks are usually more sensitive to decline than credit-based banks. The Global Financial Crisis of 2008 indicates that markets like the Securitization Market in the US can dry out fast. The shadow banking of the early 21st century dried out fast and sometimes one cannot but start to wonder if people do not learn from history. Betting and gambling on block chain currencies shows a resemblance with the betting and gambling on the Tulip markets of the 17th century, i.e. at the peak of the tulip market, a person could trade a single tulip for an entire estate, and, at the bottom, one tulip was the price of a common onion.

The institutional background is important in order to understand how banks act and perform. Every bank has a history. We have seen many bankers forget their banks history, objectives and values. This is particularly evident in the savings banks, and cooperative bank sectors, where you can find a lot of growth-oriented bankers, who have totally forgotten the purpose of the bank. Every generation seems to forget the previous generation’s experiences of financial crisis. We can indeed learn a lot from history. New products such as contracts for differences, other derivatives and block chain currencies appear to be new banking concepts. However, when you start to look at them, they are not ‘really’ new. And we have noted that it seems as though every generation of manager needs to have some new concepts that they can burn their fingers on, or even worse - other’s fingers on.

It is much easier to survive if you know where you are coming from, and why you have been successful in the past. Maintaining the memories of banking activities, and even perhaps bankers and the mistakes made by them, is important. However, to remember success is crucial in resilient banking. History does not repeat itself. However, you should know how you previously earned the trust of both the depositors and owners.

We like Kjellman [6,8] could not prove that technology nor bank platforms are crucial for resilience in banking. Still banks are every day under attack from hackers, competitors and fintech companies. Technology is part of the digitalized banking and it needs to work. We found that resilient banks controlled their technological platform. This was the case when the smaller and more resilient Swedish and Finnish savings banks saved the largest savings banks in Sweden and Finland. The most resilient banks were also found to be moderate technology adaptors. Not first movers [6-8]!

We looked at and tested different markets and sectors of banking and still could not find evidence that bank platform quality or size would be a key factor behind resilient bank management. Instead we found indications that having great tech teams could be part of the resilience puzzle. Thereby getting back to the issue of how technology and the tech teams are managed in the banks. Our findings support those of Rozovsky [15] that have been reported from the successful Google teams. The five key dynamics that set successful teams apart from other teams are [6,15]:

You need to have a trustworthy and capable bank platform though which you can sell and control the ‘money’ transactions and invest in the development of the money-product-service mix that the customers desire.

CONCLUSION

We note that banking is much more than understanding economics, legal aspects, customers and finance. When we have studied the activities of successful and unsuccessful bankers, and successful and unsuccessful banks, we have noticed that resilient managing directors seem to master a much wider range of activities. Among others they are able to create the institutional future based on historic development. Moreover, they follow in their decision-making a good moral and ethical compass. We argue that you will need to know about your past, your environment, your company culture, your customers, teamwork and your expected future before you, as a banker, stand a better chance of being successful. In our research effort, we have identified six checkpoints, the 6Ms behind resilient banking. These are: Money, Markets, Meaning, Me = We, Memories are magic, and Maintaining technology capabilities.

The limitation in our study relates to the complexity of the bank resilience process. The banking business is uncertain, comprehensive, and complex. Management of such a business is far away from an easy task. Neither is it easy to pursue research on the area in question. Thus, our research has its weaknesses.

We note that resilience in banking is a complex process of teamwork. Any manager and especially a bank manager make long-term decisions and sometimes tough ones. A comprehensive dealing with all components in resilient banking involves a good ethical and moral compass as well as an understanding of value management, i.e. meaning of the bank activity. Thus, making the understanding of resilience in banking even more complex. A bank needs to maintain a sustainable and adequate profit. In this process there are many activities and professionals involved. To manage all those components, the 6Ms model that we want to bring forward, function as checkpoints behind resilient banking. Recall sufficient own capital, liquidity; know your market, teamwork, the bank platform management, meaning as well as good and bad memories.

We argue that resilient banks have resilient bank managers, who have a solid moral and ethical compass. They look to the past and anticipate the future by helping customers, co-workers and the surrounding society and environment. An interesting topic for future research could be to look into how bank resilience could be passed on to the next generations working for a bank. That is, if the current status of activities actually supports resilience in banking?

FUNDING INFORMATION

The research has been funded by the Foundation for Economic Education in Finland.

No Files Found

Share Your Publication :